From legalizing marriage equality to advocating for society to better understand the fluidity of gender and sexuality, activists have made incredible strides for queer and trans rights and success in the U.S.

But there's a group of LGBTQ individuals that's struggling, and it's clear that changes need to be made.

LGBTQ college graduates have, on average, $16,000 more in student loan debt than the general population, according to Student Loan Hero.

Through a survey, they found that 60% of LGBTQ students regret taking out student loans, and more than a quarter of respondents feel that their debt is not manageable. Queer students face an uphill battle against student loan debt, falling even further in the debt hole than their peers.

So, why is this happening?

Miranda Marquit, the report's lead author, says there's a chance that a lack of strong familial support may be behind it.

"Only 39% [of those surveyed] feel completely accepted by their families," Marquit writes in an email to Upworthy. "Some of these borrowers might not receive the same level of support that other students receive, including the ability to live at home (33% report being kicked out) or direct financial support, leaving [them] with little option but to borrow more."

Photo by Scott Eisen/Getty Images.

In addition to lacking family support and housing, Marquit found that many borrowers often feel the need to "prove themselves" at more prestigious — and often more expensive — schools.

"Anecdotal evidence from people we've talked to indicates that there is some added pressure to show that they are super-successful and can 'make it' at more prestigious schools, which can also lead to higher debt," Marquit writes.

Photo by Andrew Caballero-Reynolds/AFP/Getty Images.

LGBTQ students also face discrimination when applying for more affordable loans and jobs, leading to long-term debt challenges.

Queer financial expert John Schneider corroborates Marquit's findings, adding via email that "many respondents to the survey said they've been discriminated against when applying for loans because they're LGBTQ. Consequently, these students may have assumed loans with less ideal, less competitive terms."

Discrimination against marginalized groups is nothing new in in this country.

Landlords frequently refused to give black Americans home loans before the Fair Housing Act in 1968, limiting black mobility and financial well-being; banks have discriminated against black and Latinx homebuyers for decades; and Asian business owners have reported discrimination in regards to health inspections for years.

The reality is that discrimination has had a persistent, pervasive impact on marginalized groups. And its effects go beyond student debt.

LGBTQ borrowers are 53% more likely than the general population to make under $50,000 per year, and less than half reported having a retirement savings account, according to the report. With limited financial stability, not only are LGBTQ graduates in debt, they're struggling just to make a dent in it.

A lot of this, according to Schneider, has to do with how we treat LGBTQ people in the first place. "We need to start truly valuing LGBTQ people and people of all diversity and backgrounds," Schneider writes. "Kicking your son or daughter out of your home or making them run away for their safety makes you an unfit parent, and society should hold you accountable. Not treating someone equal because they're LGBTQ, black, female, etc., makes you unfit for your job, and your company should let you go."

Photo by Mark Ralston/AFP/Getty Images.

While the statistics are frustrating, Marquit and Schneider believe that there's room for progress.

Marquit points out that schools could more effectively focus on better student loan education efforts to inform LGBTQ and non-LGBTQ students alike of debt realities.

Schneider says to make sure that Pride isn't just reflected on a banner but also in hiring and financial practices.

"Depending on your LGBTQ status, we can still be denied housing, employment, and services in 28-30 states in this country," Schneider writes. "So, while we appreciate the Fortune 500 companies attending and sponsoring Pride this month and putting rainbows in the logos for June, how about they push for the equality of their employees, past, present, and future, in those 28–30 states for the next 11 months?"

Our LGBTQ students deserve more, and our schools, financial institutions, and the general public can help ensure they have the financial health they deserve.

A father does his daughter's hair

A father does his daughter's hair A father plays chess with his daughter

A father plays chess with his daughter A dad hula hoops with his daughterAll illustrations are provided by Soosh and used with permission.

A dad hula hoops with his daughterAll illustrations are provided by Soosh and used with permission. A dad talks to his daughter while working at his deskAll illustrations are provided by Soosh and used with permission.

A dad talks to his daughter while working at his deskAll illustrations are provided by Soosh and used with permission. A dad performs a puppet show for his daughterAll illustrations are provided by Soosh and used with permission.

A dad performs a puppet show for his daughterAll illustrations are provided by Soosh and used with permission. A dad walks with his daughter on his backAll illustrations are provided by Soosh and used with permission.

A dad walks with his daughter on his backAll illustrations are provided by Soosh and used with permission. a dad carries a suitcase that his daughter holds onto

a dad carries a suitcase that his daughter holds onto A dad holds his sleeping daughterAll illustrations are provided by Soosh and used with permission.

A dad holds his sleeping daughterAll illustrations are provided by Soosh and used with permission. A superhero dad looks over his daughterAll illustrations are provided by Soosh and used with permission.

A superhero dad looks over his daughterAll illustrations are provided by Soosh and used with permission. A dad takes the small corner of the bed with his dauthterAll illustrations are provided by Soosh and used with permission.

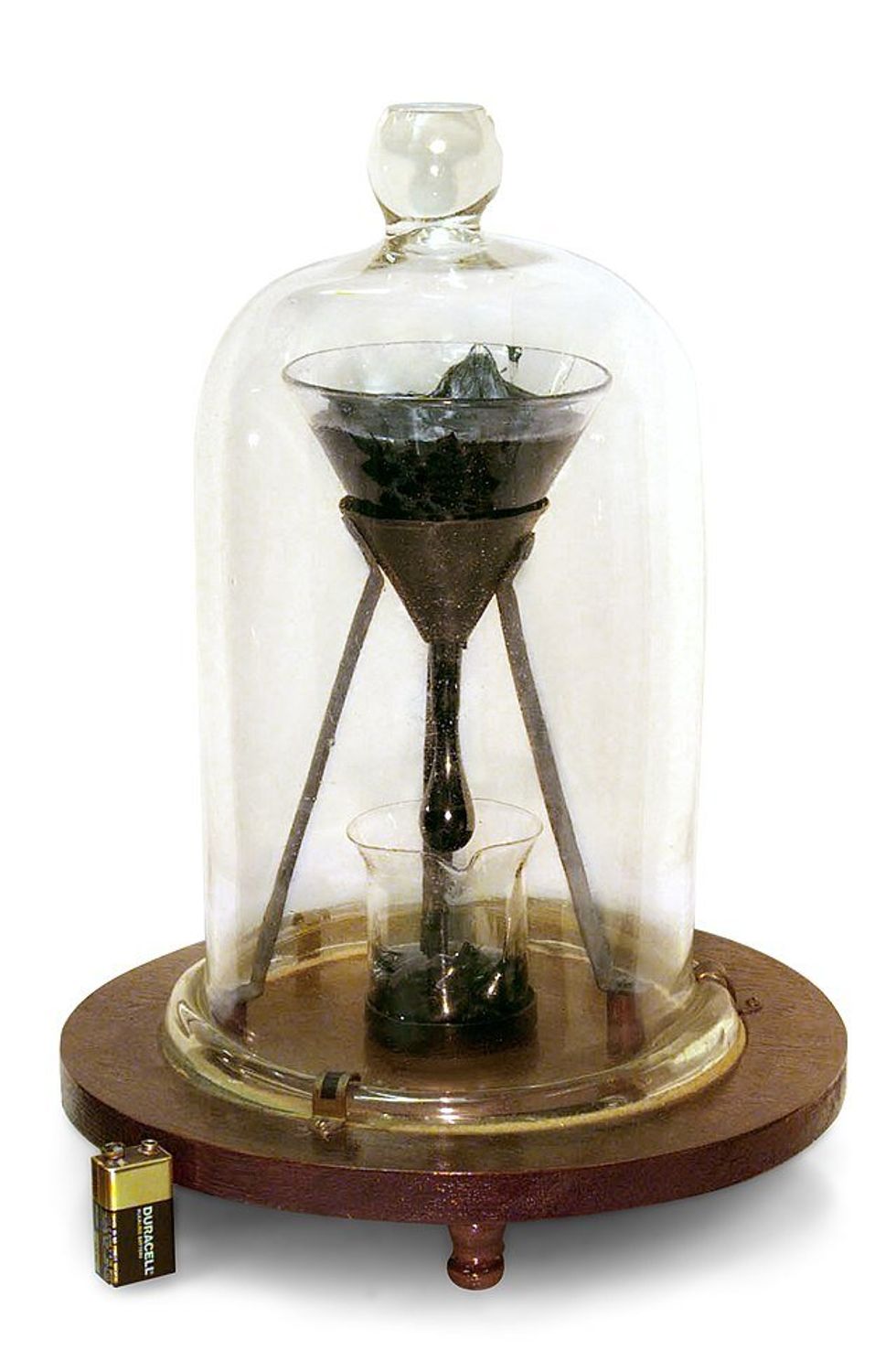

A dad takes the small corner of the bed with his dauthterAll illustrations are provided by Soosh and used with permission. Pitch moves so slowly it can't be seen to be moving with the naked eye until it prepares to drop. Battery for size reference.

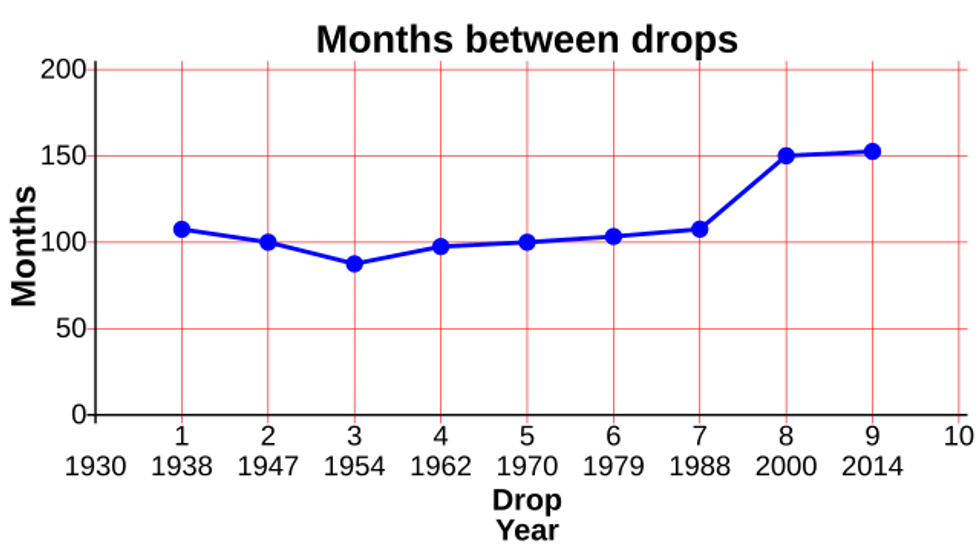

Pitch moves so slowly it can't be seen to be moving with the naked eye until it prepares to drop. Battery for size reference. The first seven drops fell around 8 years apart. Then the building got air conditioning and the intervals changed to around 13 years.

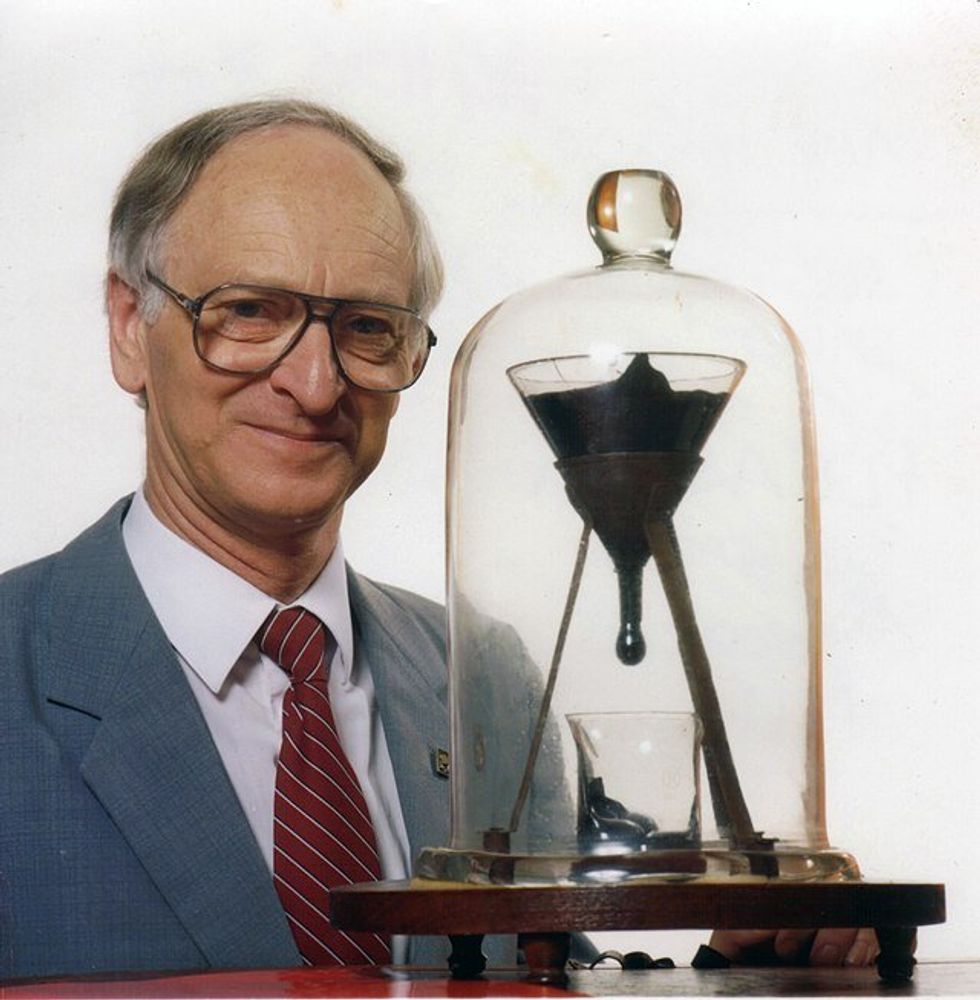

The first seven drops fell around 8 years apart. Then the building got air conditioning and the intervals changed to around 13 years. John Mainstone, the second custodian of the Pitch Drop Experiment, with the funnel in 1990.

John Mainstone, the second custodian of the Pitch Drop Experiment, with the funnel in 1990. A man yelling at a spam call. via

A man yelling at a spam call. via  A spam call boss.via

A spam call boss.via