Woman shares harrowing story of student loan debt doubling after her mom passed away

So many reforms don't address this fundamental issue.

This is why we need student loan reform.

College is expensive. Parents work multiple jobs, put pressure on their children to perform at the top of their class in order to earn merit scholarships, all in the hopes for college to be mostly paid in full. Inevitably many students and parents have to take out student loans in an effort to fill in the gaps left by financial aid.

In the case of one X user, Michelle Miller, her mother agreed to pay back half of Michelle’s student loans to ease the burden on the new graduate. After graduation the daughter owed approximately $30,000 and, split between the two of them, it meant they would each need to pay back $15,000.

Michelle lamented about how her mother insisted on paying back her agreed-upon portion of the student loans though the daughter offered to take over payments. When Michelle’s mother informed her that the original $15,000 turned into $40,000 after interest, Michelle decided to save money in preparation to take over payments. However, her mother refused to allow it. Miller’s mother was expected to pay $400 a month on the student loans, but this would cut into her retirement, leaving her below the poverty level.

I’m somewhat loath to get so personal but I feel like I need to tell this story. My mother died in December 2020 with what I believed at the time to be $40k in student loan debt.

— Michelle Miller (@michelleimiller) April 28, 2022

To her mother, it was worth it to hold up her end of the bargain. Unfortunately her mother became unexpectedly ill and passed away before she was able to retire or pay back the loans. When going through her mother’s paperwork after her death, Michelle was met with a shock. The loan amount had doubled. Michelle’s mother hid that the interest rate on the loans had brought the grand total to $80k that she could never afford to pay back.

This is what we talked about the last week my mom was alive. Loans. Student f*cking loans.

— Michelle Miller (@michelleimiller) April 28, 2022

But this story is not unique. Many borrowers go into debt thinking the benefit of the degree will outweigh the burden of student loan debt but the cost of an education continues to skyrocket and the interest rate on loans makes paying it back nearly impossible. When you go to school and take out loans, you expect to be able to afford monthly payments and hope to pay it back in a timely manner, eventually freeing up income, but that’s not always the case. A lot of people find themselves in a similar situation as Michelle’s mother. They take out a dollar amount that is repayable, only to look up and see they’ve repaid the original balance but they still owe more than they originally agreed to borrow.

If stories like Michelle’s are the norm, why aren’t we doing more to regulate student loan companies? Presidential candidates like to talk about student loan forgiveness. And in a recent announcement, President Donald Trump said he planned to “immediately” transfer the country’s $1.6 trillion student loan portfolio to the Small Business Administration, an organization that not only has zero experience handling student loans, but will also have its workforce decreased by 43%. Which is concerning, assuming it gets passed.

- YouTubewww.youtube.com

And even still, changes like these don't solve the long term issue of student loan practices. The truth of the matter is that children who three months prior had to ask permission to use the bathroom are now expected to understand the long term implications of borrowing money from a company that doesn’t care that the average person can’t pay it back plus interest.

Seventeen- and 18-year olds with a dream of attending college and questionable loan practices is a perfect storm for continued crisis in the student loan arena. Until we can figure out how to better regulate the lending companies in charge of student loans, the next generation will repeat the cycle. People shouldn’t have to choose between pursuing their dreams and taking debt to the grave.

This article originally appeared three years ago.

Potted plants and herbs can thrive in a container garden.

Potted plants and herbs can thrive in a container garden. Freshly harvested potatoes are so satisfying.

Freshly harvested potatoes are so satisfying. Do you see a box or do you see a planter?

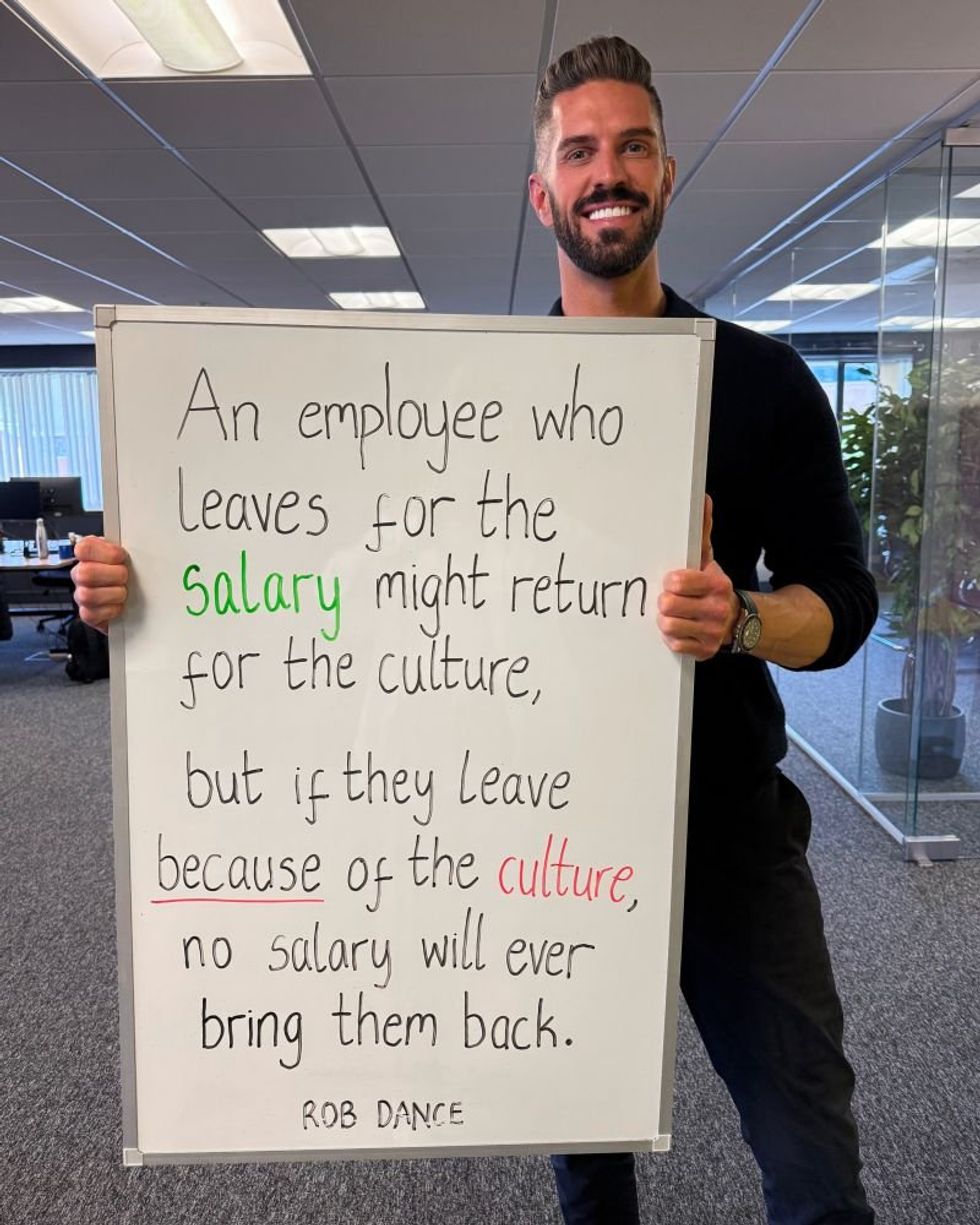

Do you see a box or do you see a planter? CEO Rob Dance holds up a whipe board with his culture philosophy.

CEO Rob Dance holds up a whipe board with his culture philosophy.  A pair of hands holding another pair of hands.

A pair of hands holding another pair of hands.