The truth about millennials and money is complex.

Millennials face different economic challenges than older generations did. I can speak from experience. Pensions feel like unicorns to us, and most of us live with a little monster called student debt on our backs that eats away at our paychecks. As a result, we have different financial priorities and goals, especially when it comes to retirement.

I would probably be less surprised if I came across this scene in a verdant pasture than if I saw a job posting with "pension plan" among the benefits. Painting by Domenichino, via Wikimedia Commons.

Admittedly, many millennials don't think hard about retirement at all. In fact, a recent study found that only 29% of millennials are "actively planning" for retirement ... but the real question is why. Why don't millennials think about retirement? And are we going to be stuck in cubicles until we're in our 80s?

Here's what the facts say.

Things may not be as bleak as they seem. GIF from "The Simpsons."

1. It's true: Millennials are not on track to cover our expenses in retirement.

When millennials think about retirement, they seriously lowball the amount of money they expect to spend, according to the Insured Retirement Institute and the Center for Generational Kinetics. Most millennials expect to spend $36,000 per year, but the average retired person actually goes through more like $47,000.

Another dicey finding from this study? Almost a quarter of millennials think they're going to bankroll their retirement years through the lottery or financial gifts. Yikes.

2. At this rate, many millennials will probably have to delay retirement, which means (in some cases) working until age 75.

A lot of millennials aren't planning to save for retirement until they've paid off their student loan debt, which can take a decade or more.

And it's more than just retirement that's getting delayed. In fact, one-third of recent graduates are saying that they're planning on living at home right after graduation so they can start paying it back. It's a domino effect that delays all sorts of life decisions, like getting married or buying a house.

Photo via 401(K) 2012/Flickr.

3. But more millennials are saving a decent amount of money — and sooner than their parents.

Last year, one survey found that about 56% of millennials are saving at least 5% of their income, which is 6 points higher than the year before! And other research has found that this generation began saving at a median age of 22, which follows a downward trend — reports show Gen X started around 27 and boomers at 35.

4. Plus, Americans in general (not just millennials) are planning to retire later.

In fact, the lack of focus on retirement might have more to do with a switch in mindset than a lack of financial knowledge.Stats show that the number of non-retired people who say they plan to retire after age 65 has grown from 14% in 1995 to 31% in 2009 and 37% in 2015. The expected age at retirement has been creeping up for a while.

Nary a latte in sight. Photo by ITU Pictures/Flickr (altered).

When most millennials entered adulthood, the economy was collapsing, the job market was super bleak, and the housing crisis was in full swing.

So while the majority of millennials appear to be pretty good at saving money when they can, the context is important. In general, millennials tend to avoid investments because the stock market seems like a house of cards, and the job market still feels fairly tenuous.

Millennials do, in fact, have financial priorities. But for most of them, there's a generational switch going on: Quitting work for the last couple decades of their lives isn't at the top of their priority list. Most 20-somethings are taking advantage of 401(k)s when they can, but they're also saving their money for meaningful experiences — like travel — because they'll be satisfied by a "semi-retirement."

You can't do this with an IRA. GIF from "Mad Men."

Courtesy of Kerry Hyde

Courtesy of Kerry Hyde Courtesy of Kerry Hyde

Courtesy of Kerry Hyde Courtesy of Kerry Hyde

Courtesy of Kerry Hyde Courtesy of Kerry Hyde

Courtesy of Kerry Hyde A heart shaped neon sign in the dark

Photo by

A heart shaped neon sign in the dark

Photo by

Photo by

Photo by

The paint companies are dying to know the secret formula for the new color.

The paint companies are dying to know the secret formula for the new color. A close-up of the human eye.

A close-up of the human eye.  Lady Liberty welcomes people to New York.

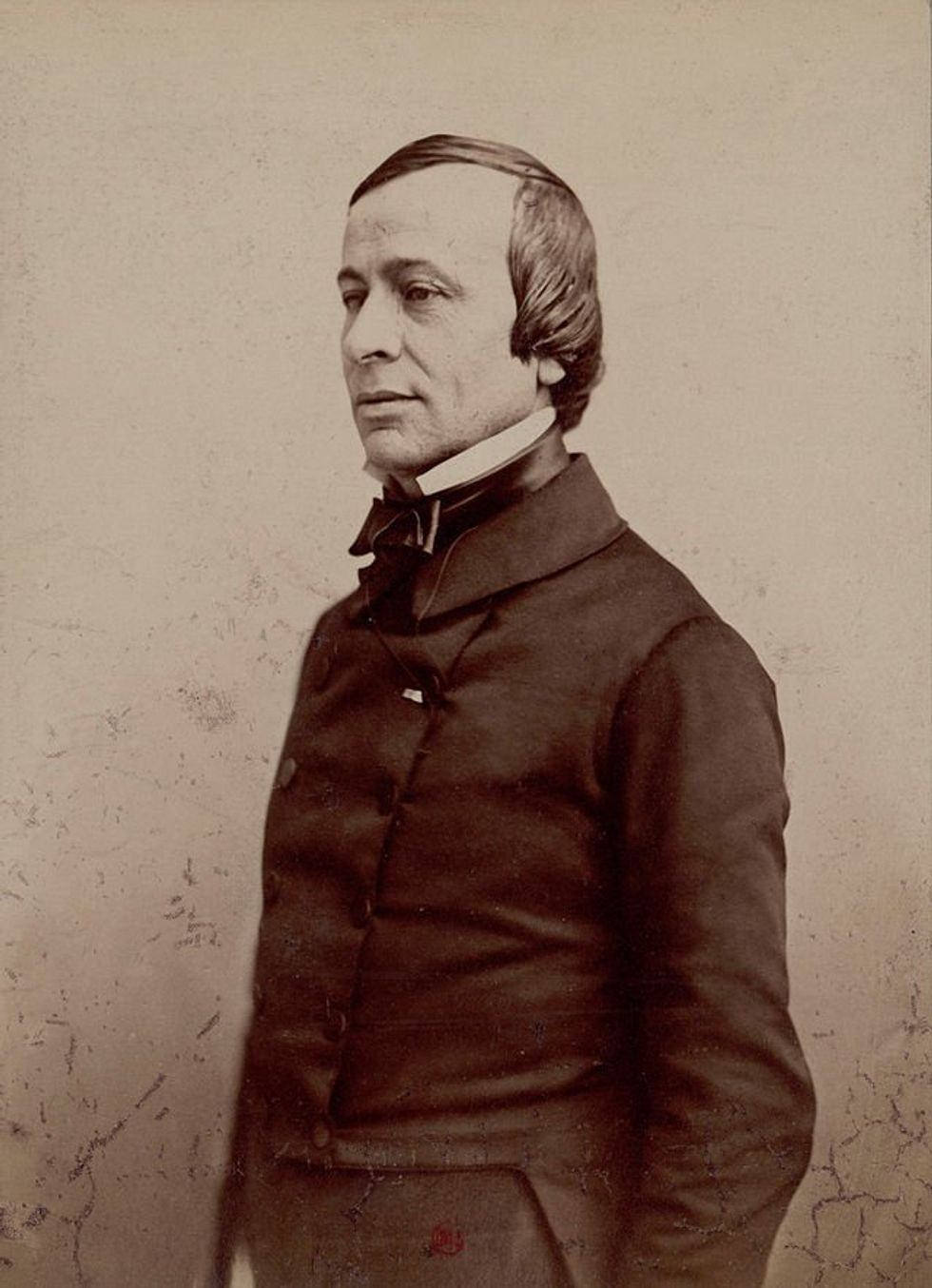

Lady Liberty welcomes people to New York. French abolitionist Édouard René de Laboulaye, who commissioned the Statue of Liberty.

French abolitionist Édouard René de Laboulaye, who commissioned the Statue of Liberty.